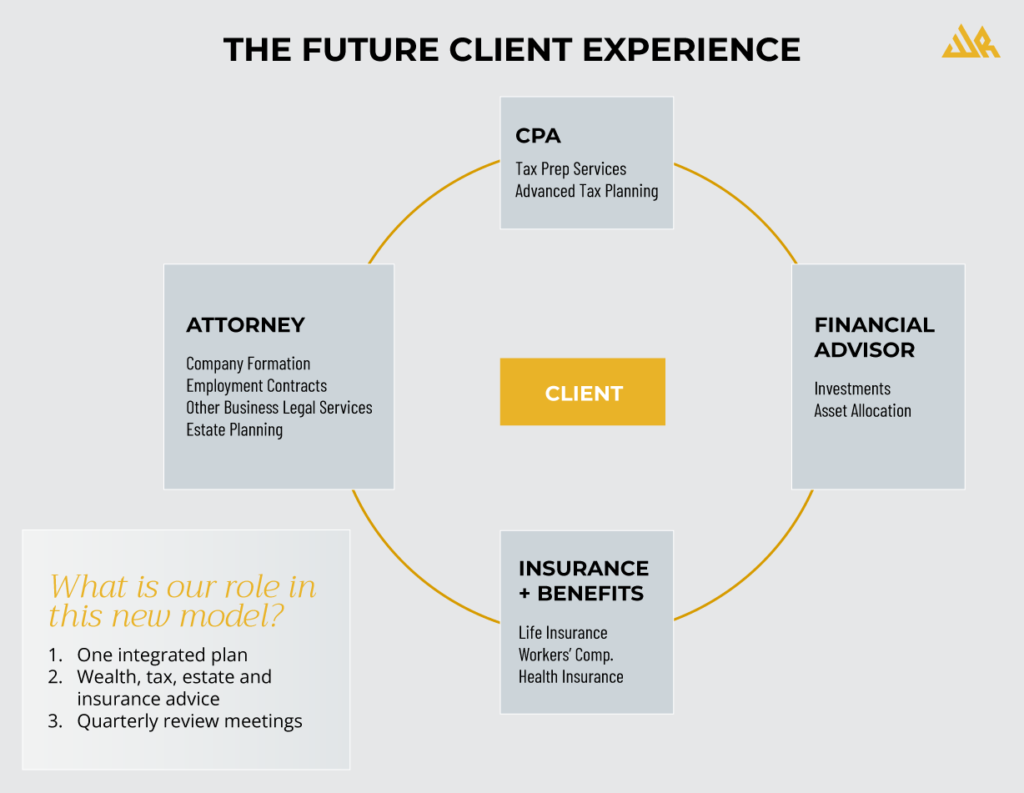

Your advisors shouldn’t exist in silos. In silos, advisors can give overlapping and conflicting advice which is time consuming for you, the client.

YOU

YOU

YOU

YOU

WR Wealth Planners is a well-respected advanced planning firm with a distinct advantage for high-net-worth business owners. We believe that clients should not have to self-navigate across a myriad of financial services providers. At WR, we bring our team of experts together to create and implement sophisticated strategies encompassing wealth planning, tax mitigation, succession and estate structure, and insurance solutions. Your wealth. Our expertise. One integrated plan.

WR Wealth Planners is a well-respected advanced planning firm with a distinct advantage for high-net-worth business owners. We believe that clients should not have to self-navigate across a myriad of financial services providers. At WR, we bring our team of experts together to create and implement sophisticated strategies encompassing wealth planning, tax mitigation, succession and estate structure, and insurance solutions. Your wealth. Our expertise. One integrated plan.

At WR Wealth, we specialize in comprehensive wealth management services tailored to meet the unique needs of each client. We leverage our expertise to craft personalized plans that navigate complexities and drive your wealth forward.

Carroll and Ben are such a wonderful team! They are incredibly knowledgeable and passionate about helping their clients. If you want advisers who truly care, listen, and have a holistic planning approach, WR Wealth is the place to go!

Professional and Trustworthy. I have been working with Carroll and Ben for a few years now and couldn’t be happier with the service and friendship they have provided. I know my best interest is always first.

These guys are not your cookie cutter financial advisors. If you are with a franchised financial advisor and feel like having a more personal relationship with a smaller firm, these are your guys. Well respected and highly recommended.

Professional office. Worked with them for a year and a half now, very reliable and honest.

CIC CPRM MLIS

Smart wealth planning decisions are crucial for clients as they navigate life changes and work towards achieving their financial objectives. These decisions enable individuals to adjust to various transitions, such as marriage, parenthood, career shifts, retirement, or unexpected events like medical emergencies or economic downturns. Effective wealth planning is not merely about numbers and investments; it involves addressing emotional complexities and personal values.

Finding the right wealth advisor can be a daunting task. The process involves more than just assessing qualifications or experience; it requires finding someone who understands the client’s unique circumstances, values, and goals.

By making informed decisions and collaborating with the right advisor, clients can navigate life transitions with confidence and work towards a secure financial future.

Lorem ipsum dolor sit amet consectetur adipiscing elit porta, scelerisque fames dui rutrum bibendum vulputate.

Get valuable Insights straight to your inbox weekly

Your Wealth. Our Expertise. One Integrated plan.

Disclosure: Investment Advisory Services offered through WR Wealth Planners, a Registered Investment Advisor. Learn More. Form CRS is a simple and easy-to-read summary regarding the nature of a retail client’s relationship with our firm. Click here For more tips on evaluating advisors